The Department of Communications, Climate Action and the Environment’s (DCCAE) 2017 National Mitigation Plan highlighted carbon pricing as a core component of the overall strategy to reduce emissions and improve climate change performance. On its introduction in 2010, the Irish carbon tax imposed a rate of €10 per tonne on the importer or extractor of carbon intensive goods including motor and heating fuels. This rate proved insufficient in inducing an adequate behaviour change and despite the increase to €20 per tonne in 2014, a significant further increase was recommended by the ESRI (DeBruin and Yakut, ESRI, 2018). This culminated in the government’s commitment to introducing a carbon price trajectory designed and monitored so as to ensure the rate sends a strong signal to carbon users and incentivizes a transition toward less carbon intensive products. The price per tonne was increased by €6 to €26 in the 2020 Budget with the expectation for further increases along this trajectory as we move toward 2030 and the €80 per tonne target set down in the 2019 Climate Action Plan (CAP).

Summary

Since 2010 Ireland have had a carbon tax, levied on the extractor or importer of carbon intensive goods, with the costs being passed down to consumers. This Pigouvian approach to taxing pollution involves internalizing the social and environmental costs of an activity so as to shift behaviour toward more socially optimal behaviours (Grossman, 2019). The current rate of €26 per tonne fails to fully account for the social cost of carbon emissions, however, the 2030 target rate of €80 per tonne, outlined in the CAP, comes closer to the $150-$800 Social Cost of Carbon estimated by Ricke et al. (2018) and is more likely to shift consumer behaviour away from carbon intensive goods.

When increasing the rate in October 2019, the government promised that the additional €90m raised would be ring fenced to fund climate action measures and protect the most vulnerable members of society. While a full outline on the use of this revenue was not provided, the Oireachtas Committee on Climate Action report from March 2019 offered some recommendations and insights, including that the tax be behaviour changing as opposed to revenue raising. Two options for re-circulating the income of what they suggest should be a revenue neutral tax were put forward:

1. Alleviating the burden placed on low income households of increased fuel costs by compensating those most at risk of fuel poverty based on key indicators such as income, accommodation type or exceptional energy needs. The balance should then be used to finance climate actions such as retrofits and infrastructural transitions. Such an approach has been implemented in Alberta, Canada since 2017.

2. Return proceeds to all households through a fee and dividend scheme. This approach is similar to the Swiss model which returns approximately 50% of revenues to households in uniform lump sums with the remainder used to finance green projects.

Given the EU 2030 climate and energy framework targets of 40% Greenhouse Gas Emissions reduction, 32% renewable share and 32.5% improvement in energy efficiency, as well as the CAP’s more ambitious target of carbon neutrality by 2050, there exists a clear intuitive rationale for imposing a higher price on carbon than the market rate. This intuition was tested by DeBruin and Yakut (2018) using the ESRI’s Energy Social Accounting Matrix (ESAM) to analyse the economy wide impact of an increase in the carbon tax. They estimate that the energy transformation sector (particularly natural gas supply) and the transport sector will be most affected by carbon tax increases. Conversely, they predict the production sector to be insensitive to carbon-tax increases. As such, increasing the carbon tax will have little impact on the competitiveness of Ireland’s exports.

In terms of emission reductions, the ESRI recommend a significant increase in the carbon tax if it is to assist Ireland in meeting the aforementioned targets. Their findings are consistent with the intuition that setting a more prohibitive price signal will shift behaviour away from environmentally harmful behaviours, but also that such a policy will impact the poorest decile of the population most heavily. This may be down to the inelastic nature of transport and heating expenditure in the short run.

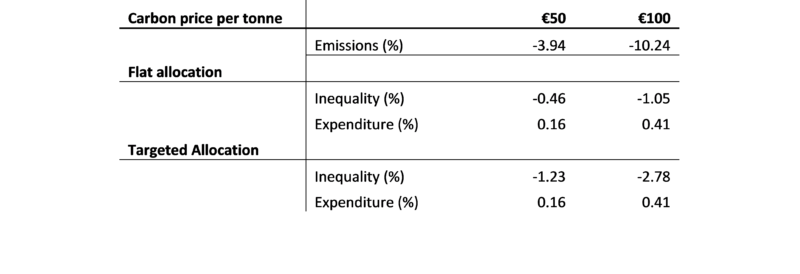

Table 1: Impact of a Carbon Tax Increase

Source: DeBruin and Yakut (2018)

Table 1 conveys both the overall environmental impact of carbon tax increases (relative to the pre 2019 €20 per tonne rate), with emission reductions and distributional inequality apparent even from small increases. We see the obvious positive relationship between the price of carbon and the cost relative to income is more pronounced among the poorest households. The political sustainability and indeed the extent to which Carbon Tax policy is regressive depends on how the government addresses these distributional effects (Sterner, 2007). Failure to adequately account for the disproportionate impact to low-income and rural households (Ruzickova, 2019) and to use the revenues to fund the ecological transition and counter balance any social effect of this transition contributed to the civil unrest in Paris in December 2018 and January 2019 (Piketty, 2018). Eager to avoid a similar response to the carbon tax, the Irish government sought public consultation before increasing the tax and has promised to protect the most vulnerable in society from the increases through corresponding fuel allowance provisions.

Sufficient carbon pricing is a vital tool in reducing climate change in a cost-effective manner while causing minimal distortions in other markets (Nordhaus, 1993). As highlighted above, setting a higher price signal has the effect of shifting behaviour away from carbon intensive goods and by extension reducing emissions. Given the fact that the carbon tax is already in existence, administration costs associated with the proposed increase would be negligible however as discussed, there is a social cost of a carbon tax increase, with low income households likely to be particularly affected and at risk.

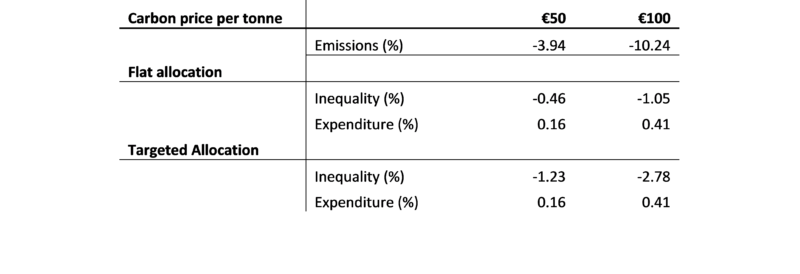

If this is adequately accounted for when the revenues are redistributed, the alleviation of income inequality could be an ancillary benefit of the policy. In defending the 2019 increase, Taoiseach Leo Varadkar suggested that while it would cost the poorest 20% of households an estimated €44 per year, an increase in the fuel allowance of €56 per year would leave them better off (O’Halloran, 2019). Tovar Reaños and Lynch (ESRI, 2019), predicted similar results as they investigated the efficacy of fee and dividend schemes in redistributing wealth. Fee and dividend schemes involve redistributing the revenues raised from the carbon tax to households either on a flat allocation with all households receiving the same dividend or a targeted allocation which redistributes the revenue proportionately compensating those most heavily affected. Table 2 highlights how effective such programs can be in reducing both emissions and inequality.

Table 2: Redistribution of Revenue

As we can see, even a simple flat allocation fee and dividend scheme can mitigate some of the inequality issues caused by increasing carbon tax. The government’s method of choice – increasing social welfare payments – was not investigated in this study, however as the tax rises toward €80 the government must continue to pro-actively protect those in society most affected by it.

References

De Bruin, K. and Yakut, A.M., 2018. The Economic and Environmental Impacts of Increasing the Irish Carbon Tax. Research Series Paper Number, 79.

Groosman, Britt. n.d. “2500 Pollution Tax.” Encyclopedia of Law and Economics. Accessed 28 06, 2019. http://encyclo.findlaw.com/2500book.pdf.

Jan Burck, Franziska Marten, Christoph Bals, Niklas Höhne, Carolin Frisch, Niklas Clement, Kao Szu-Chihe Climate Change Performance Index: Results 2018. Berlin: Germanwatch.

Nordhaus, W.D., 1993. Optimal greenhouse-gas reductions and tax policy in the” DICE” model. The American Economic Review, 83(2), pp.313-317.

O’Halloran, M. (2019). Taoiseach accused of being ‘green poseur’ in carbon tax Dáil row. Irish Times. Retrieved from https://www.irishtimes.com/news/politics/taoiseach-accused-of-being-green-poseur-in-carbon-tax-d%C3%A1il-row-1.4045207

Pavla Ruzickova, 2019. “Macron’s reforms: What has driven the yellow vest protesters to take to the streets?,” Occasional Publications – Chapters in Edited Volumes,in: CNB Global Economic Outlook – July 2019, pages 12-22 Czech National Bank.

Piketty, T. (2018). Yellow Vests and Tax Justice. LeMonde. [online] Available at: http://piketty.blog.lemonde.fr/2018/12/11/yellow-vests-and-tax-justice/ [Accessed 25 June , 2019]

Ricke, K., Drouet, L., Caldeira, K. and Tavoni, M., 2018. Country-level social cost of carbon. Nature Climate Change, 8(10), p.895.

Sterner, T., 2007. Fuel taxes: An important instrument for climate policy. Energy policy, 35(6), pp.3194-3202.

Tovar Reaños, M. and Lynch, M.Á., 2019. Distributional impacts of carbon taxation and revenue recycling: a behavioural microsimulation (No. WP626). Economic and Social Research Institute (ESRI)

Keywords

Reference this

Policymeasures.com (2022). Carbon Tax (Ireland). Available at: https://policymeasures.com/measure/carbon-tax-ireland/. Last accessed: 05-06-2022.